Bitcoin can find the perfect combination in the options market. Moreover, the Bitcoin option contract is an important measure of market sentiment and currently shows the spot market has a more favorable outlook before Valentine's Day.

Valentine effect on Bitcoin price

According to Su Zhu, CEO of Three Arbow Capital, there was a "wild fluctuation" in the Bitcoin options contract that expires on Friday, February 14, 2020.

In the context of general market conditions, volatility tends to increase over time as Bitcoin trades at $ 9,781 and is testing $ 10,000.

Aggressive skew for next Fri 14feb (Valentine’s day) expiry, the options mkt is expecting big moves up the next 7days https://t.co/iK1IOBfoeG

- Su Zhu (@zhusu) February 7, 2020

"Fluctuating wildly until the expiry date on Friday to February 14 (Valentine's Day), the options market is expecting strong strides in the next 7 days."

As such, the charts show that the "BTC - February 14, 2020" contract is appreciating significantly compared to contracts that expire on February 21, February 28, or expire one month later on 27 / 3.

The potential volatility (IV) for ‘Valentine's Day Contract’ is as high as 80%, compared to other contracts with an IV of about 70%.

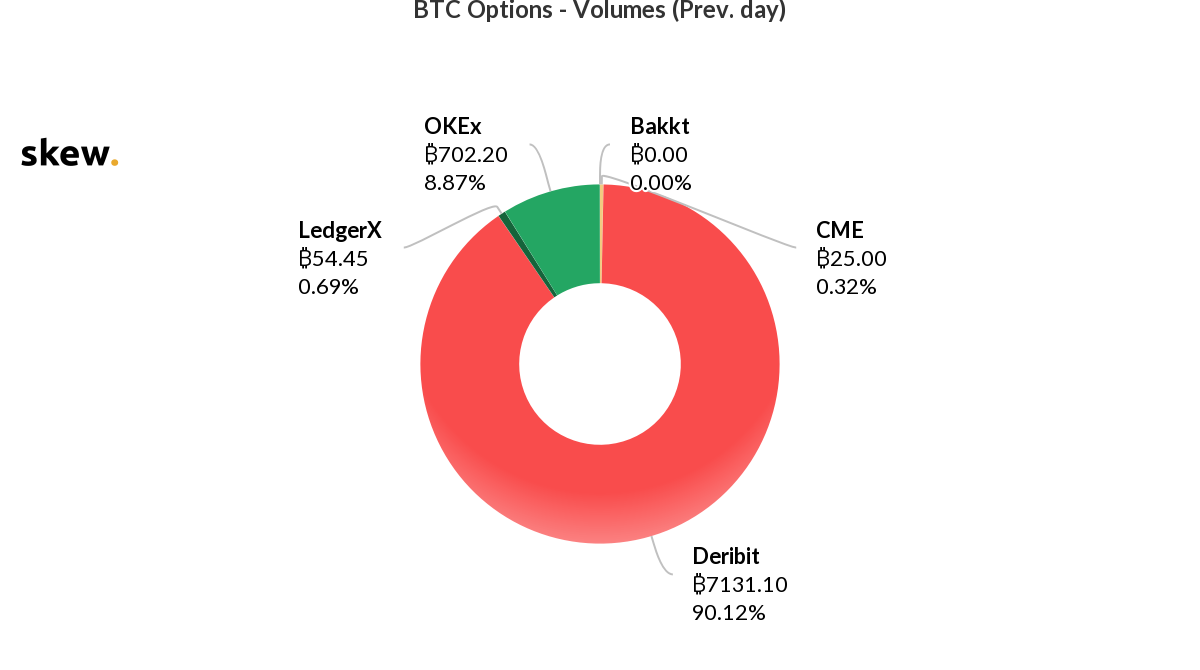

According to data from Skew, Deribit accounted for more than 90% of the volume of Bitcoin options, based on the volume from the previous trading day (February 6, 2020).

More than 7,130 BTC were traded on the exchange, accumulating a volume of nearly $ 70 million.

Source: Contract size of Bitcoin options Source: Skew

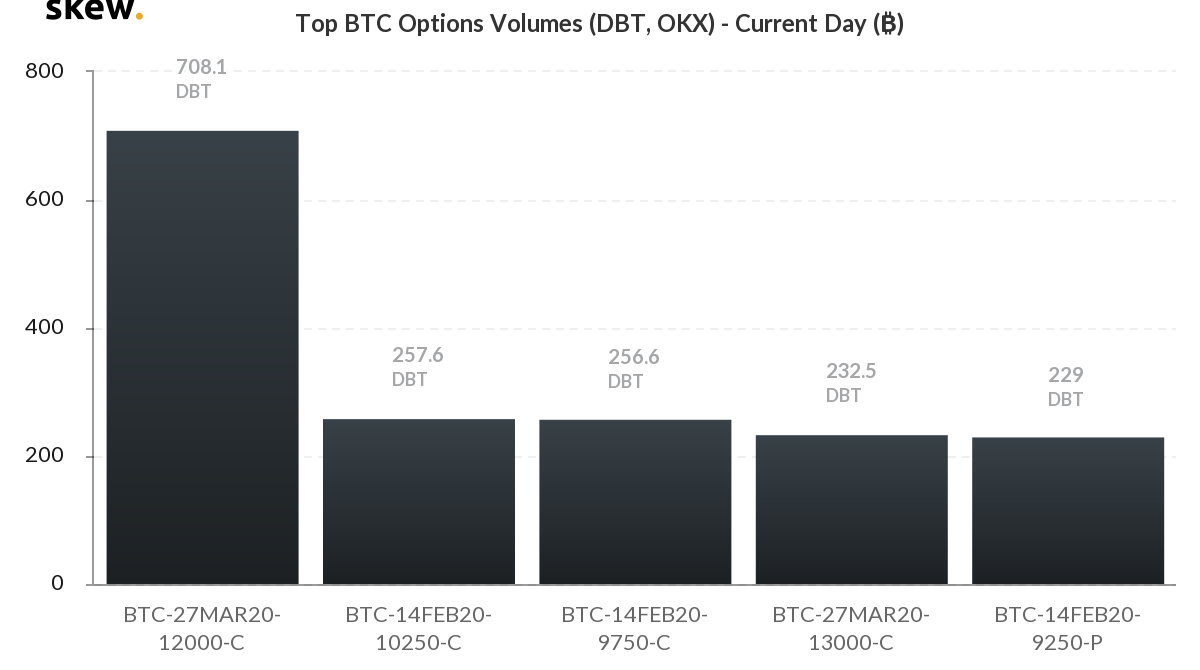

The volume figures show the exact nature of the uptrend. In terms of volume of 700 Bitcoin by expiry date and price, the contracts on March 27 are rising at $ 12,000. Valentine's contracts took the next two positions at $ 10,250 and $ 9,750, respectively, with volumes of 256.6 and 256.6 Bitcoin respectively.

The ‘bittersweet’ pullback is also present with 229 Bitcoin options, expected to drop to $ 9,250.

Source: Volume of Bitcoin option contracts - Deribit, OKX | Source: Skew

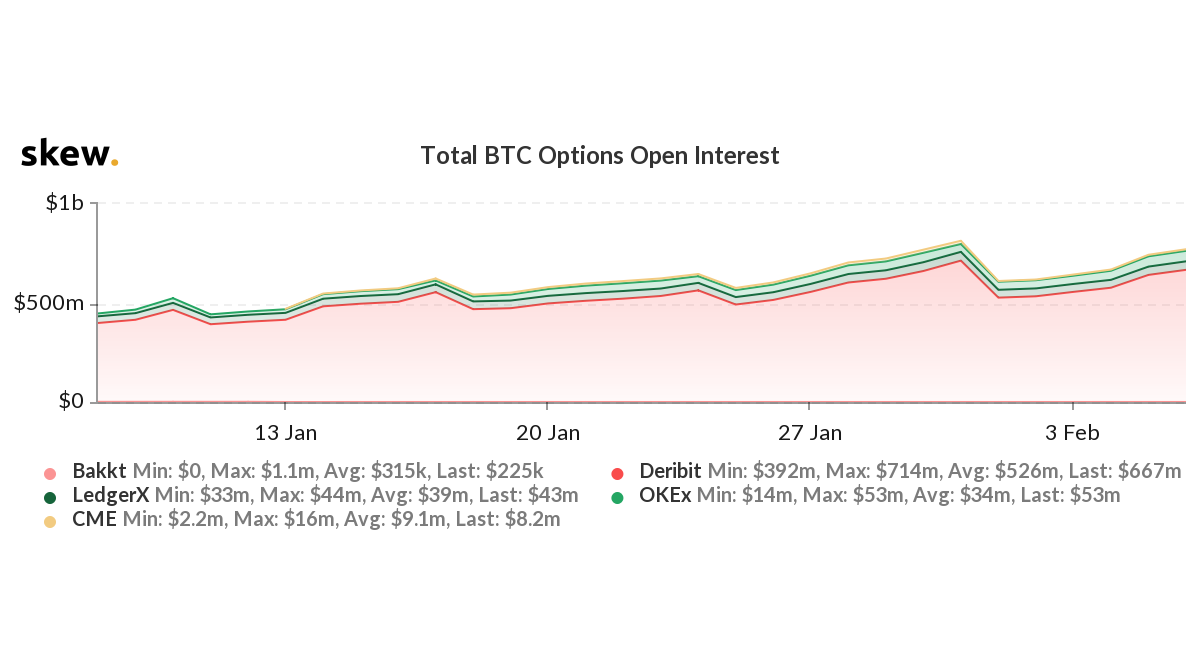

In terms of open positions (OI) on Bitcoin options contracts at the derivatives exchange, the data far exceeds that of both regulated and unregulated competitors.

On February 6, Deribit's OI had over $ 650 million and OKEx came in second with a volume of $ 53 million. Bakkt, the digital asset platform of the Intercontinental Exchange, has a total of approximately $ 225,000 worth of positions - almost never on the chart.

Bitcoin's recent rally was halted when BTC was rebuffed several times earlier today after attempting to overcome the stiff resistance that exists between $ 9,800 and $ 10,000.

However, this strong resistance has not yet caused any noticeable sell-offs, so it appears to show some potential strength of buyers and may be about to break.

Further strengthening this upside potential is the BTC volume delta which also seems to indicate potential upside.

Bitcoin bulls attempt to break through strong resistance

At the time of writing, Bitcoin is trading at $ 9,782. That's where it was active yesterday when the bull tried to broaden its recent momentum.

Price of BTC today | Source: Coinmarketcap

It is important to note that BTC has made a lot of effort over the past several hours to gain a foothold in the $ 9,800 area, but all of these efforts have been fruitless, due to selling pressure at This is quite intense.

If buyers can push the top cryptocurrency to above $ 9,800, analyst George believes that BTC will rise to at least $ 10,200 and further breaks will result in $ 12,000.

10.2k at least imo. Clean break above and concell be targeting 12k. pic.twitter.com/ldX3wkY7Bv

- George (⛷️) (@ George1Trader) February 7, 2020

"imo tMinimum of 10.2k. If successful, it will be targeted target 12k dollars ”.

Delta mass BTC are considered huhdeals for buyers right now

Another technical factor that could also push the bulls is the Bitcoin volume delta signaling another impending increase, although it is unclear whether the magnitude of this increase is sufficient to push BTC above the critical resistance. override above or not?

Analyst Cantering Clark talked about the BTC volume delta in a recent tweet, explaining that the region is currently heavily sold.

This one seems a bit simple right now.

Pretty obvious cumulative volume delta divergence.

You hope for setups this conspicuous.

Area heavily sold. Now just get price back above 9800 and lean on them.

Right under key market structure. No major rejections, just grind.$ BTC pic.twitter.com/qjJA0HOptx

- Cantering Clark (@CanteringClark) February 7, 2020

"CIt seems a bit simple right now. Delta divergence kThe accumulated amount is quite clear. You hope about these conspicuous settings. Area sold too much. Now, Just get the price above 9.800 dollars and rely on them. Right below the profile bamboo market important. If denied, will very pathetic ”.

The next few hours will give us a clear view of the importance of $ 9,800 for long-term Bitcoin price action, as a break above this level could catalyze the possibility of a strong increase, while being rejected. here will lead to big losses.

Disclaimer: This is not investment advice. Investors should research carefully before making a decision. We are not responsible for your investment decisions.

Thuy Trang

Bitcoin Magazine

• Updated news at Telegram

Crypto loans are only from 5.9% annual interest rate - you can use the money effectively without selling coins. Earn up to 8% interest per year with stablecoin, USD, EUR & GBP with insurance up to 100 million. Come on, get started now! →

0 Comments